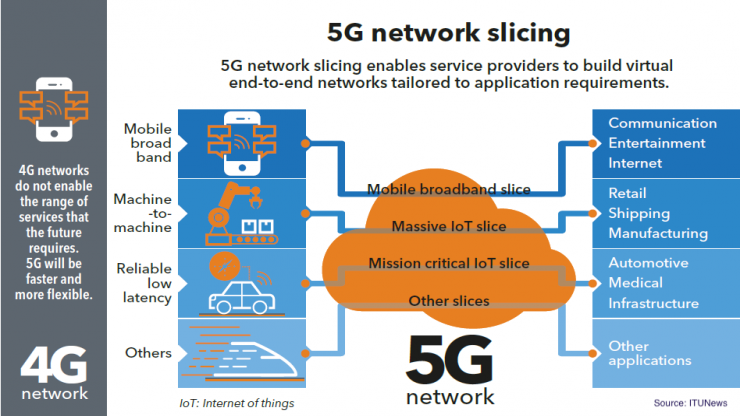

Past precedent is of less value going forward. Statements by regulators shed some light on the factors that are likely to tip the balance one way or the other.įurther, 5G raises new questions on how operators will compete in the future (for example, the requirement underĥG for networks with an increased density of cell towers may make investment more important), which may mean Which development prevails is likely to be fact specific to the case at hand, though recent cases and However, they may also reduce competitive tension between MNOs and dampen their incentives to invest. By improving the economics of 5G investment, mergers and NSAs may increase the scale of investment and the speed of 5G roll out. Both mergers and NSAs have the potential to benefit consumers through increased investment. These trends and market uncertainties are putting pressure on MNOs to achieve investment efficiencies through mergers, or by cooperating through jointly deploying and sharing elements of their networks (known as “network sharing agreements” (NSAs)). At this stage, it is also unclear whether the COVID-19 pandemic will exacerbate these challenges or accelerate the development and adoption of new use cases. New use cases that would enable MNOs to monetizeĥG may be on the horizon, but it is unclear when they will arrive and what types of new revenue streams they will This is putting pressure on current MNO business models. This need for new capital expenditure arrives at a time when, even though connections and data usage by consumers are increasing, MNO revenues and average revenue per user (ARPU) have been flat or declining for several years. The upgrade from 4G to 5G and the expansion of 5G networks requires significant investment from mobile network operators (MNOs).

However, the business case for 5G investment remains unclear.

With its promise of improvements to performance and functionality, 5G is the next generation of wireless technology.

0 kommentar(er)

0 kommentar(er)